What's Ponzi?

Let's start from old version of scam: Ponzi Scheme ☠️

|

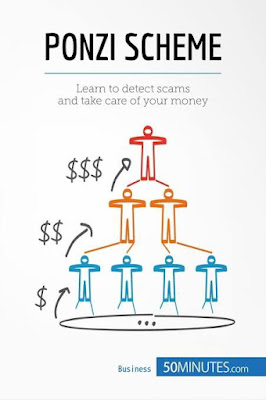

| Ponzi Scheme, almost the same with pyramid scheme but has differences in some parts. |

A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors. The Ponzi scheme generates returns for early investors by acquiring new investors. This is similar to a pyramid scheme in that both are based on using new investors' funds to pay the earlier backers. Both Ponzi schemes and pyramid schemes eventually bottom out when the flood of new investors dries up and there isn't enough money to go around. At that point, the schemes unravel.

Ponzi Scheme Exposed!!

A Ponzi scheme is an investment fraud in which clients are promised a large profit at little to no risk. Companies that engage in a Ponzi scheme focus all of their energy into attracting new clients to make investments

☠️ Similar to a pyramid scheme, the Ponzi scheme generates returns for older investors by acquiring new investors, who are promised a large profit at little to no risk.

☠️ Both fraudulent arrangements are premised on using new investors' funds to pay the earlier backers.

☠️ Companies that engage in a Ponzi scheme focus all of their energy into attracting new clients to make investments.

This new income is used to pay original investors their returns, marked as a profit from a legitimate transaction. Ponzi schemes rely on a constant flow of new investments to continue to provide returns to older investors. When this flow runs out, the scheme falls apart.

Origins of the Ponzi Scheme

The Ponzi scheme is named after a swindler named Charles Ponzi, who orchestrated the first one in 1919. The postal service, at that time, had developed international reply coupons that allowed a sender to pre-purchase postage and include it in their correspondence. The receiver would take the coupon to a local post office and exchange it for the priority airmail postage stamps needed to send a reply.

The constant fluctuation of postage prices meant that it was common for stamps to be more expensive in one country than another. Ponzi hired agents to purchase cheap international reply coupons in other countries and send them to him. He would then exchange those coupons for stamps that were more expensive than the coupon was originally purchased for. The stamps were then sold at a profit.

Ponzi schemes rely on a constant flow of new investments to continue to provide returns to older investors.

This type of exchange is known as an arbitrage, which is not an illegal practice. But Ponzi became greedy and expanded his efforts.

Under the heading of his company, Securities Exchange Company, he promised returns of 50% in 45 days or 100% in 90 days. Due to his success in the postage stamp scheme, investors were immediately attracted. Instead of actually investing the money, Ponzi just redistributed it and told the investors they made a profit. The scheme lasted until August of 1920, when The Boston Post began investigating the Securities Exchange Company. As a result of the newspaper's investigation, Ponzi was arrested by federal authorities on August 12, 1920, and charged with several counts of mail fraud.

Ponzi Scheme Red Flags

The concept of the Ponzi scheme did not end in 1920. As technology changed, so did the Ponzi scheme. In 2008, Bernard Madoff was convicted of running a Ponzi scheme that falsified trading reports to show a client was earning a profit on investments that didn't exist.

Regardless of the technology used in the Ponzi scheme, most share similar characteristics:

☠️ A guaranteed promise of high returns with little risk

☠️ Consistent flow of returns regardless of market conditions.

☠️ Investments that have not been registered with the Securities and Exchange Commission (SEC).

☠️ Investment strategies that are secret or described as too complex to explain

☠️ Clients not allowed to view official paperwork for their investment.

☠️ Clients facing difficulties removing their money.

A Ponzi scheme can maintain the illusion of a sustainable business as long as new investors contribute new funds, and as long as most of the investors do not demand full repayment and still believe in the non-existent assets they are purported to own.

Comments